Timber and panel import volumes performed strongly in October 2020 for the fifth consecutive month since June, according to the latest timber statistics for October 2020.

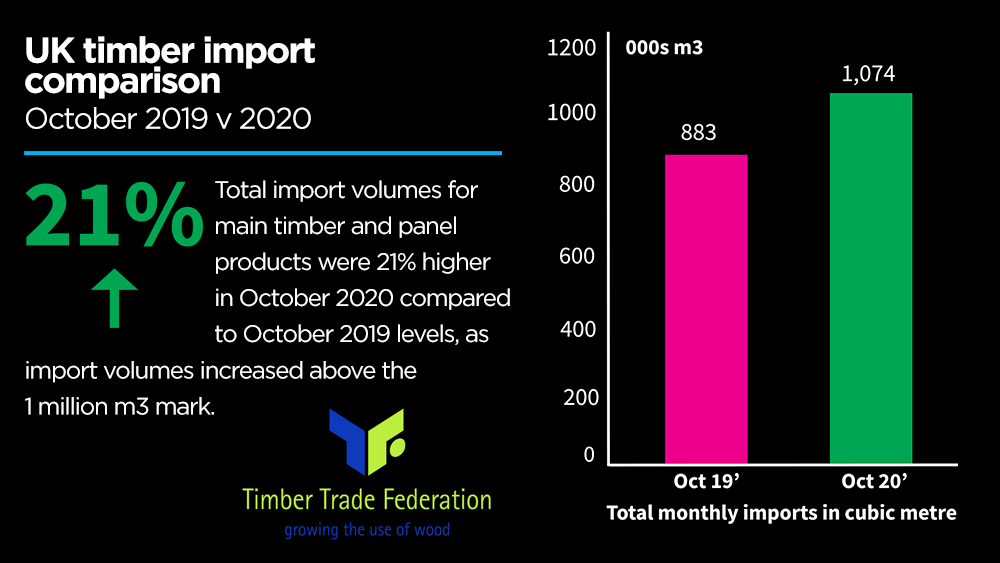

The Timber Trade Federation (TTF) monthly report reveals that total import volumes for main timber and panel products were 21% higher in October 2020 than they were in October 2019, as import volumes in the month soared above the 1 million m3 mark.

However, even this strong performance cannot compensate for the loss of volume in Q2. This means that the ten months to October 2020 still lag 11% below the same period last year. Solid wood imports were 8% below the same period in 2019 and panel product imports were 15% lower.

The main drivers of growth in the early Autumn were OSB and softwood imports, supported by higher volumes of plywood and MDF compared to the same period in 2019. Collectively, these four products have led to a 15% (377,000m3) increase in the latest three months for which data is available (August-October 2020).

Softwood import volume topped over 700,000m3 in October 2020, the highest October volume since 2003. The main contributors were Sweden and Latvia, with Germany and Russia also exporting more to the UK that month than in October 2019.

OSB imports in October 2020 were 54,000m3, the highest in the ten months to October, and a 68% increase from the volumes seen in October 2019 (32,000m3).

MDF imports continued a steady increase reaching its highest monthly total in 2020 with 77,000m3 and an 18% increase from October 2019 (65,000m3).

Plywood imports continued to show a strong recovery reaching triple figures for the second consecutive month with 111,000 m3 in October 2020, slightly bettering the previous year’s imports (107,000m3 in October 2019).

Commenting on the figures, David Hopkins, CEO of the Timber Trade Federation, said: “This year has seen demand increase considerably across all products, while supply chains have been severely disrupted as a result of the COVID pandemic, so it is good to see imports rebound so strongly.

“From talking to our members, we expect the statistics for the last two months of 2020 to continue to show this trend and end the year only slightly below 2019 imports, which would be a remarkable achievement given the circumstances.

“However, despite this comeback in supply, we must reiterate that the supply situation remains tight with suppliers keeping most customers on allocation until further notice. These statistics are a positive sign, but we have some way to go before balancing the market demand.”