The latest Construction PMI report shows housing construction rising at its quickest pace since September 2022, with business optimism remaining relatively upbeat.

In the latest Construction Purchasing Managers’ Index (PMI) survey, compiled by S&P Global Market Intelligence from responses to questionnaires sent to a panel of around 150 UK construction companies, respondents reported a sustained rebound in total business activity in August, although the pace of expansion eased slightly since July.

Robust new order growth and a more supportive economic backdrop underpinned the latest recovery in construction output volumes. Employment numbers stagnated as cost considerations meant that some firms opted to delay backfilling vacancies during August.

However, construction companies remained optimistic about the near-term demand outlook. Exactly 50% of the survey panel anticipate a rise in output during the year ahead, while only 9% forecast a reduction.

At 53.6 in August, the headline S&P Global UK Construction PMI – a seasonally adjusted index tracking changes in total industry activity – registered above the 50.0 no-change value for the sixth month running. The latest reading was lower than July's 26-month high of 55.3, but still signalled a solid expansion of overall construction output.

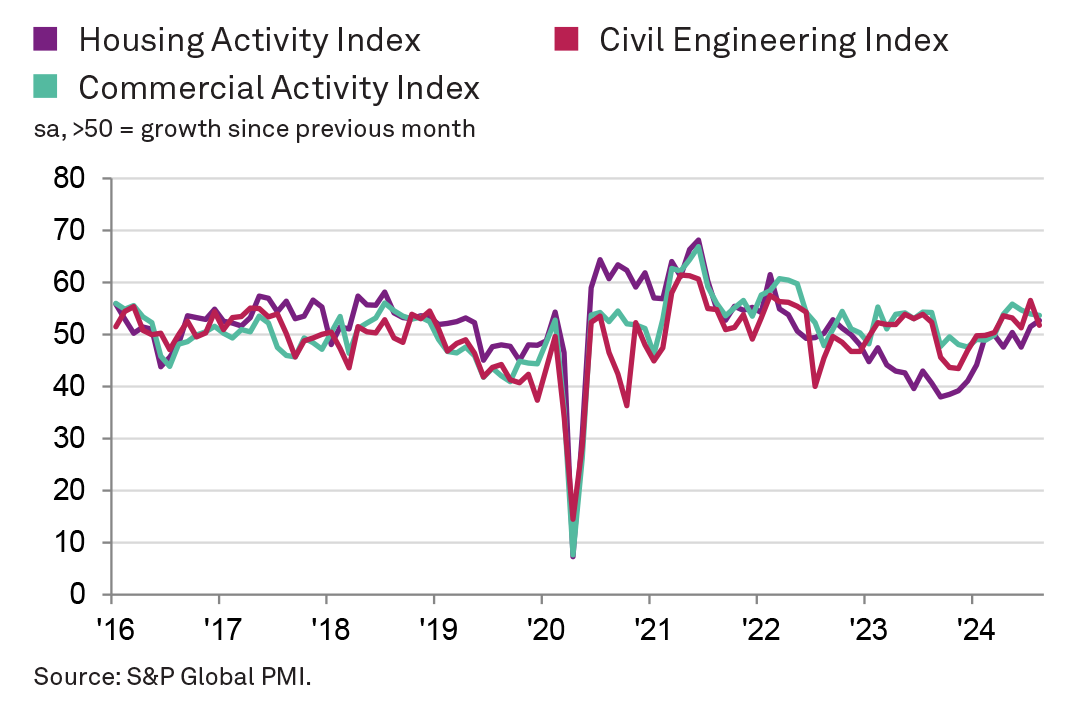

Commercial activity was the best-performing segment (index at 53.7), despite the pace of growth slipping to its lowest since March. A number of firms noted a boost from rising sales enquiries and the release of new orders following the general election.

Civil engineering activity (51.8), meanwhile, expanded at only a moderate pace that was notably weaker than in July. Residential work was the only sub-sector to gain momentum, with growth accelerating to its fastest since September 2022 (52.7). Higher levels of housing activity were supported by improving market conditions and lower borrowing costs.

August data indicated another robust increase in total now work across the construction sector. The rate of expansion was much stronger than seen on average in the first half of 2024. Survey respondents suggested that improving economic conditions and greater domestic political stability had lifted customer demand.

Strengthening order books and an upturn in sales pipelines underpinned positive sentiment regarding the year ahead business outlook. Confidence levels were much higher than at the same time in 2023. That said, some firms cited concerns about public sector budgets and longer-term prospects for infrastructure spending.

August data indicated that staffing levels were broadly unchanged, which ended a three-month period of expansion. Moreover, sub-contractor usage decreased for the first time since January. Some firms noted that elevated wage pressures had led to delays with staff hiring, while others commented on a lack of candidates to fill vacancies.

Purchasing price inflation meanwhile remained relatively muted in August, with cost pressures easing since the previous month. Construction companies cited rising raw material prices and shipping costs, but some suggested that competitive market conditions had helped to limit suppliers' pricing power.

Input buying expanded at a solid pace, which extended the current period of growth to four months. Stronger demand for construction inputs reflected rising workloads and new project starts, although some firms noted destocking efforts. Meanwhile, suppliers' delivery times shortened on average in August, but a number of survey respondents commented on constrained haulage capacity.

Tim Moore, Economics Director at S&P Global Market Intelligence, said: "The UK construction sector appears to have turned a corner after a difficult start to 2024, with renewed vigour in the house building segment the most notable development in August. Residential work expanded at the fastest pace for almost two years as lower borrowing costs and a gradual recovery in market conditions helped to boost activity.

"Commercial building was the best-performing part of the construction sector as the improving UK economic backdrop resulted in stronger order books, but the postelection bounce in demand faded somewhat in August. "Another robust expansion of incoming new work was recorded in August, highlighting that new project starts are set to support a broader rebound in construction activity during the months ahead.

"Improving sales pipelines and a turnaround in demand conditions led to a relatively strong degree of business optimism across the construction sector. However, some firms cited a slowdown in civil engineering activity and concerns about the outlook for infrastructure work as constraints on growth expectations."