According to the latest statement by the co-chairs of the Construction Leadership Council’s Material Supply Chain Group, little has changed in construction material supply since this Group’s last statement in December 2024.

Most had expected activity in the construction sector to increase in Q1 following the Chartered Purchasing Institute’s (CPI) December 2024 report showing slight but clear growth. However, we have seen the opposite, with activity shrinking back in January due to the late start and weather disruptions, followed by a significant fall in the overall level of construction activity in February. The latest decline was driven by residential building activity, which contracted for the fifth consecutive month and civil engineering, which contracted at its fastest pace since 2020.

Within the current market, there are few reports of supply issues. However, some price increases have started to come through. The expectation is that the overall increase in the cost of construction products this year will be between 2% and 8%, depending on product type, with energy-intensive products seeing the largest increase. With ongoing negotiations, there is also uncertainty around UK-American tariffs, which may affect the price of steel.

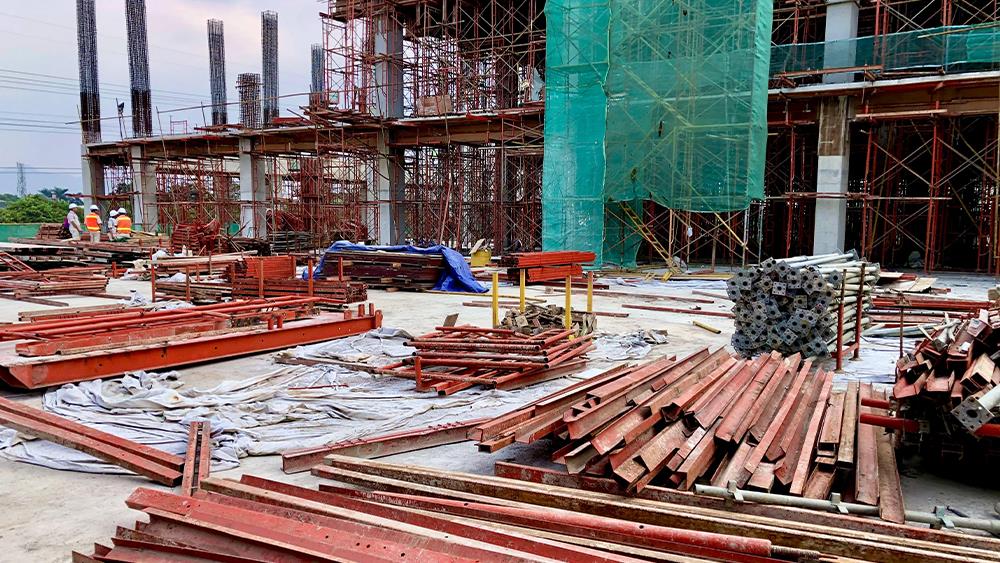

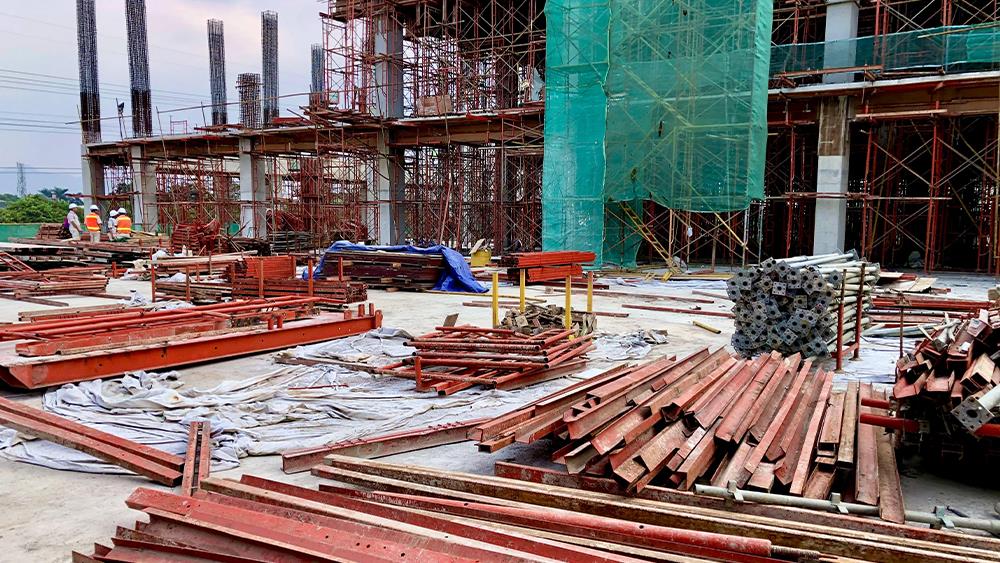

In anticipation of market growth during the year, builders’ merchants are focused on having a range of stock on the ground to meet demand. Members of the Group strongly advocate that the construction industry continues to work closely with their supply chain and forecast and communicate their requirements early with suppliers, distributors and builders’ merchants to assist in production planning and delivery.