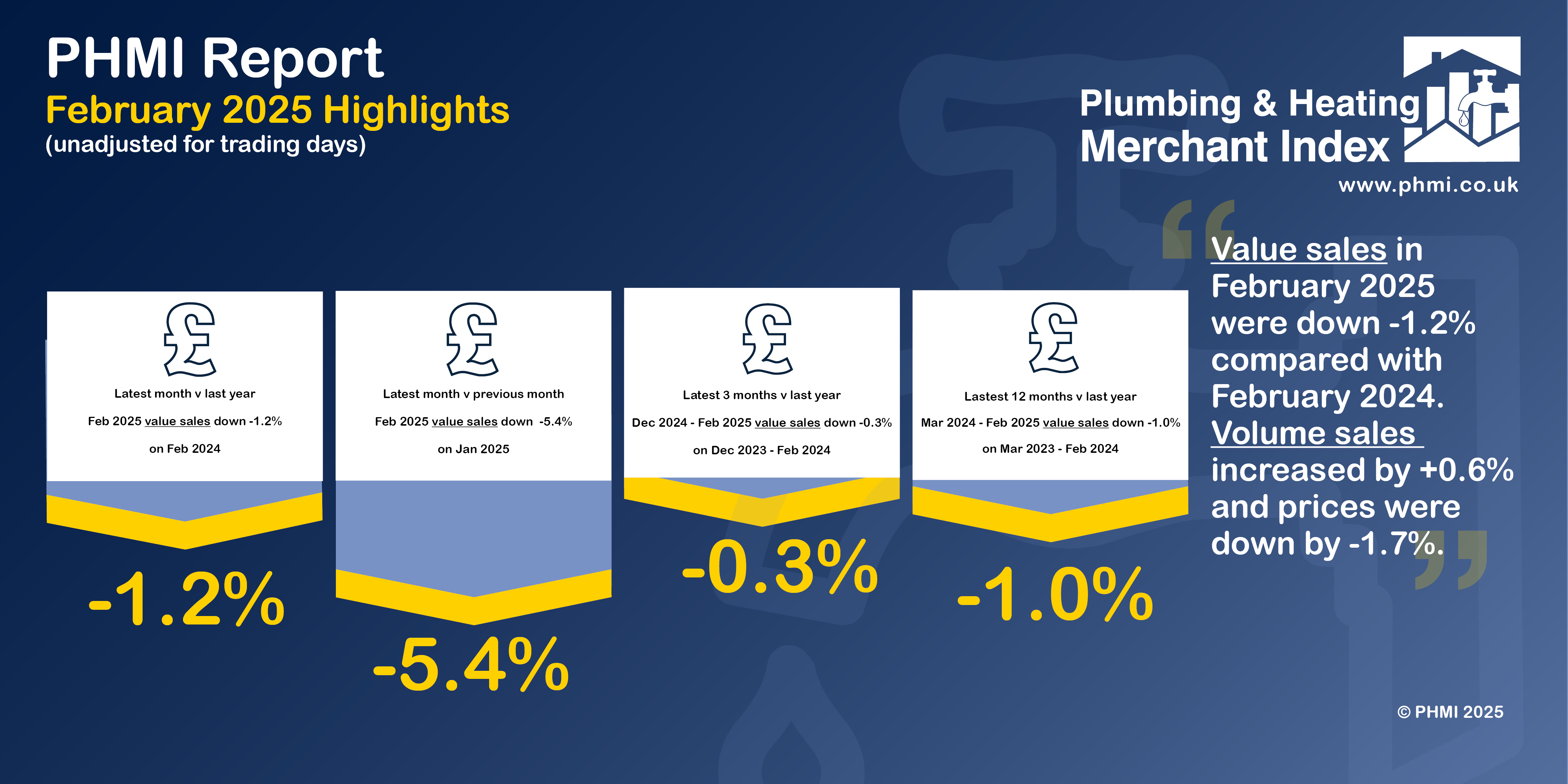

The latest figures from the Plumbing & Heating Merchant Index (PHMI) report show total value sales for February 2025 through specialist plumbing and heating merchants were down -1.2% compared to February 2024.

Volume sales increased +0.6% while prices fell -1.7% year-on-year. With one less trading day this year, like-for-like value sales increased to +3.8%.

Month-on-month, February value sales were -5.4% below January. Volume sales dropped -6.8% and prices edged up +1.5%. With two less trading days in February, like-for-like value sales increased +4.1%.

Total value sales in the three months from December 2024 to February 2025 were slightly down (-0.3%) compared to the same period a year ago. Volume sales rose +4.8% but price fell -4.8%. There was no difference in trading days.

Value sales in the three months December 2024 to February 2025 were -11.7% lower compared to the previous three months, September 2024 to November 2024. With six less trading day in the most recent period, like-for-like value sales were -2.7% lower. Volume sales were -14.1% lower and prices were up +2.9%.

Plumbing & Heating merchants’ value sales in the 12-month period from March 2024 to February 2025 were down -1.0% on the previous 12-month period (March 2023 to February 2024). Volume sales were up +3.6% while prices fell -4.5%. There was no difference in trading days.

February’s PHMI index was 104.6. With one less trading day compared to the Index base period, the like-for-like value sales Index was 108.1.

Mike Rigby, CEO of MRA Research, which produces the report, commented: “Specialist Plumbing and Heating Merchants’ value sales were down on February 2024, and down on January 2025, but on a like-for-like basis, which takes trading days into account, February was comfortably above February last year (+3.8%) and January this year (+4.1%). The latest ONS construction data shows volumes went up +0.4% in February, with new work (+0.3%) and repair and maintenance (+0.5%) both increasing marginally in output.

“The metrics suggest growth is gradually returning to construction, but the wheels are turning very slowly. Official figures from ONS suggest only 150,000 new homes are on track to be built in 2025, a far cry from the 300,000 needed each year to fulfil Labour’s 1.5 million homes target.

“Can this meagre growth build momentum, amid the global turmoil created by Trump’s tariff negotiations? There are early indications of the effects of the uncertainty on supply chains, material costs, investment and new housing projects.

“Uncertainty is one way of putting it. Neil Bellamy, consumer insight director at GfK commenting on the April index, put it more strongly: ‘April was an extraordinarily unsettling month as the tariffs controversy that began earlier in the year filtered through to consumer sentiment. April’s figures capture the economic issue with a five-point drop in how consumers feel about the economy over the last year, which is down to -3, six points worse than April 2024.

"Looking ahead over the next 12 months, the picture is even more bleak with expectations for the general economy falling by eight points to -37, this is 16 points worse than a year ago.’ Trump’s shenanigans are rattling confidence around the world.”