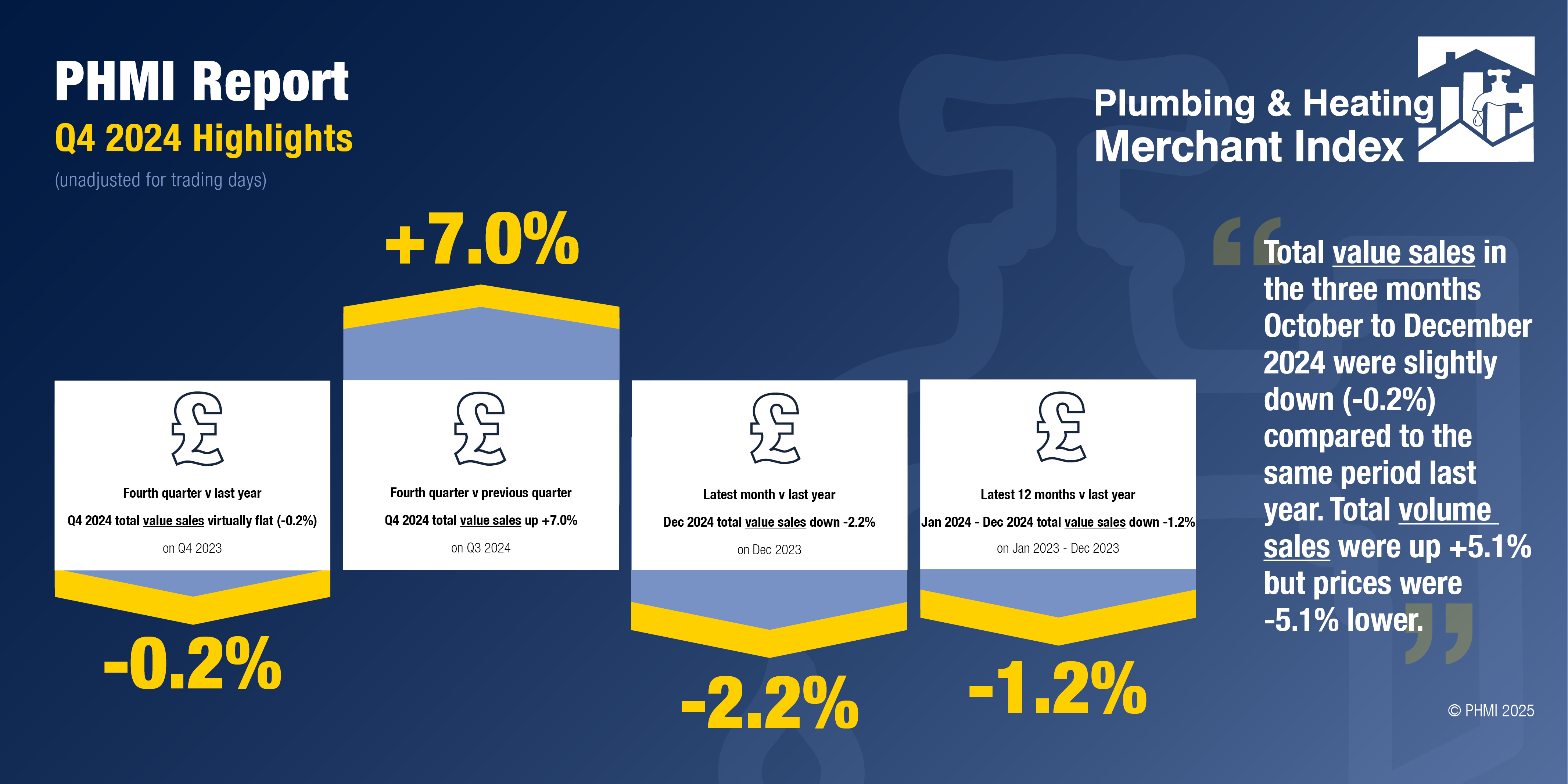

The latest Plumbing & Heating Merchant Index (PHMI) report shows Q4 2024 total value sales through specialist Plumbing & Heating merchants were marginally down (-0.2%) compared to Q4 2023.

Volumes sales increased +5.1% but prices were down -5.1%. With one more trading day in the most recent period, like-for-like value sales were -1.9% lower.

Quarter-on-quarter, total value sales for October to December 2024 were +7.0% higher than Q3 - July to September 2024. This was driven by price increases (+9.9%) as volume sales fell -2.6%. With four less trading days in Q4, like-for-like value sales were +14.0% higher.

Q4 sales weren’t helped by December sales, which were down -2.2% year-on-year. An increase in volume (+6.5%) was offset by a -8.2% drop in prices. There was an additional trading day in December 2024, leaving like-for-like value sales down -8.0%.

Compared to the preceding month, December value sales were down -28.5%. Volume sales were -31.0% lower and prices edged up +3.7% compared to November. With four less trading days in December, like-for-like value sales were -11.6% lower. This is largely in line with seasonal trading patterns.

Total value sales in the 12 months from January to December 2024 were 1.2% down against the annual sales for 2023. Volume sales were up slightly (+2.2%) for the year, while prices decreased -3.3%. With three extra trading days in 2024, like-for-like value sales were -2.4% lower.

The PHMI Index for December 2024 was 81.9. With four less trading days versus the Index base period, the like-for-like index was 99.6.

Mike Rigby, MD of MRA Research, which produces the report, commented: “For all the Government’s rhetoric about building houses and getting Britain back on track for growth, 2024 fizzled out with a pretty lacklustre Q4 which left specialist Plumbing & Heating Merchants a few percentage points behind where they were this time last year.

“The latest GB construction data from ONS shows a similar picture for the construction industry, with a marginal increase (+0.5%) in output in Q4 despite a -0.2% fall in December, and overall a modest +0.4% improvement in output for 2024 compared to 2023. Nothing to write home about.

“The general malaise about the economy and prospects for the future is being felt by consumers too. The latest Consumer Confidence Index from NIQ GfK shows a drop in all metrics at the turn of the year with the biggest drops being to people’s perception of the general economic situation over the next 12 months (-8). January’s overall index fell -5 points to -22 – the lowest it has been in over a year.

“Turning all those frowns upside down is going to take some doing. However, for the plumbing and heating merchants, there are some very promising plans which could be rolled out in 2025 to boost and diversify trade although these may not yet be ‘oven ready’. The Future Homes Standard comes into force in 2025 (date still TBC) and is set to bring with it a raft of demand for low and zero carbon products, then there’s the £3.4 billion investment to upgrade 300,000+ homes through the Warm Homes Plan in 2025-26 which includes the Boiler Upgrade Scheme and planning reforms to boost heat pump uptake.

“With the death knell expected for gas boilers to be announced later this year too, this could be a year of transition for the heating and plumbing industry and its supply chain. Those who stay agile in such a changing landscape will undoubtedly reap the rewards.”