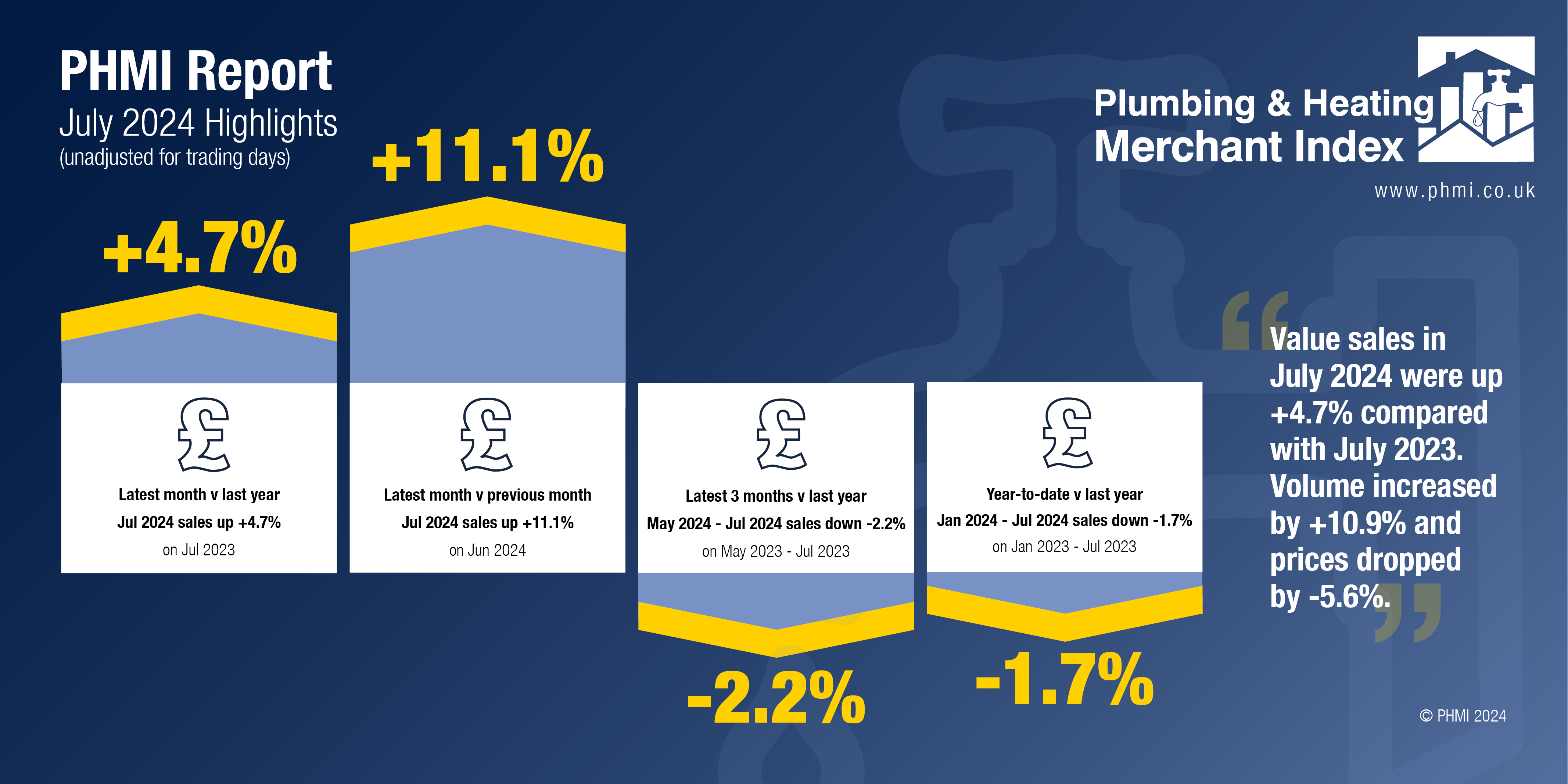

The latest figures from the Plumbing & Heating Merchant Index (PHMI) report show total value sales for July 2024 at specialist plumbing and heating merchants were up +4.7% compared to July 2023. Volumes increased +10.9% while prices dropped -5.6%.

With two extra trading days in July 2024, like-for-like sales (taking trading day differences into account), were -4.4% lower than the same month a year before.

Compared to June, July value sales jumped +11.1%. Volume sales increased +15.7% and prices fell -4.0%. With three more trading days in July, like-for-like sales were -3.4% lower.

Total value sales in the three months May to July 2024 were down -2.2% compared to the same period a year ago. There was a modest increase in volume sales (+3.4%) while prices fell -5.5%. With one more trading day in the most recent three-month period, like-for-like sales were down -3.8%.

Compared to the previous three-month period (February to April 2024), value sales in the three months May to July 2024 were -6.2% lower. Volume sales increased +2.1%, but prices dropped -8.1%. With two more trading days in the most recent period, like-for-like sales were -9.1% down.

Plumbing & Heating merchants’ value sales in the latest 12-month period from August 2023 to July 2024 were slightly down (-0.7%) on the previous 12-month period (August 2022 to July 2023). Volume sales slipped -1.8% and prices edged up +1.1%. With four more trading days this year, like-for-like value sales were down -2.3%.

July’s PHMI index was 100.0. With two extra trading days compared to the base period, the like-for-like index was 89.8.

Mike Rigby, CEO of MRA Research, which produces the report says: “Plumbing and Heating Merchants seemed to be turning the corner in July and growing despite an uninspiring set of results from the construction industry – a -0.4% drop overall in output for the month with five out of nine sectors decreasing in volume according to the latest ONS data.

“The new Government has its work cut out to steer the economy back to growth and rebalance the public purse, but Labour’s promise to build 1.5 million new homes over the next five years has boosted confidence in the industry and its supply chains. But how long before there are spades in the ground to fulfil that pledge, assuming the Government implements its planning reforms quickly and the industry finds enough skilled people to build them, remains to be seen.

“August’s cut to interest rates will give mortgage holders breathing room and extra cash for home improvements, and further cuts are expected. But GfK’s Consumer Confidence Index (front-page lead story in the Financial Times 20 September) with a -7-point fall in the overall index last month, and down -7 from the General Election is an early warning to the Government. All five measures are down, but the three forward looking indicators are very sharply down. Our personal financial situation for the next 12 months, down -9; our view on the general economy for the coming year, down -12; and the major purchase index, down -10 are bad news for the economy.

“Consumers appear to have taken the Government’s economic black hole alert to heart following the withdrawal of winter fuel payments and Chancellor Reeves’ grim warnings of a painful budget. Given that consumer confidence underpins consumer spending, which underpins economic growth, which the Government says it wants, the Prime Minister’s and Chancellor’s dire warnings could be a costly own goal”.