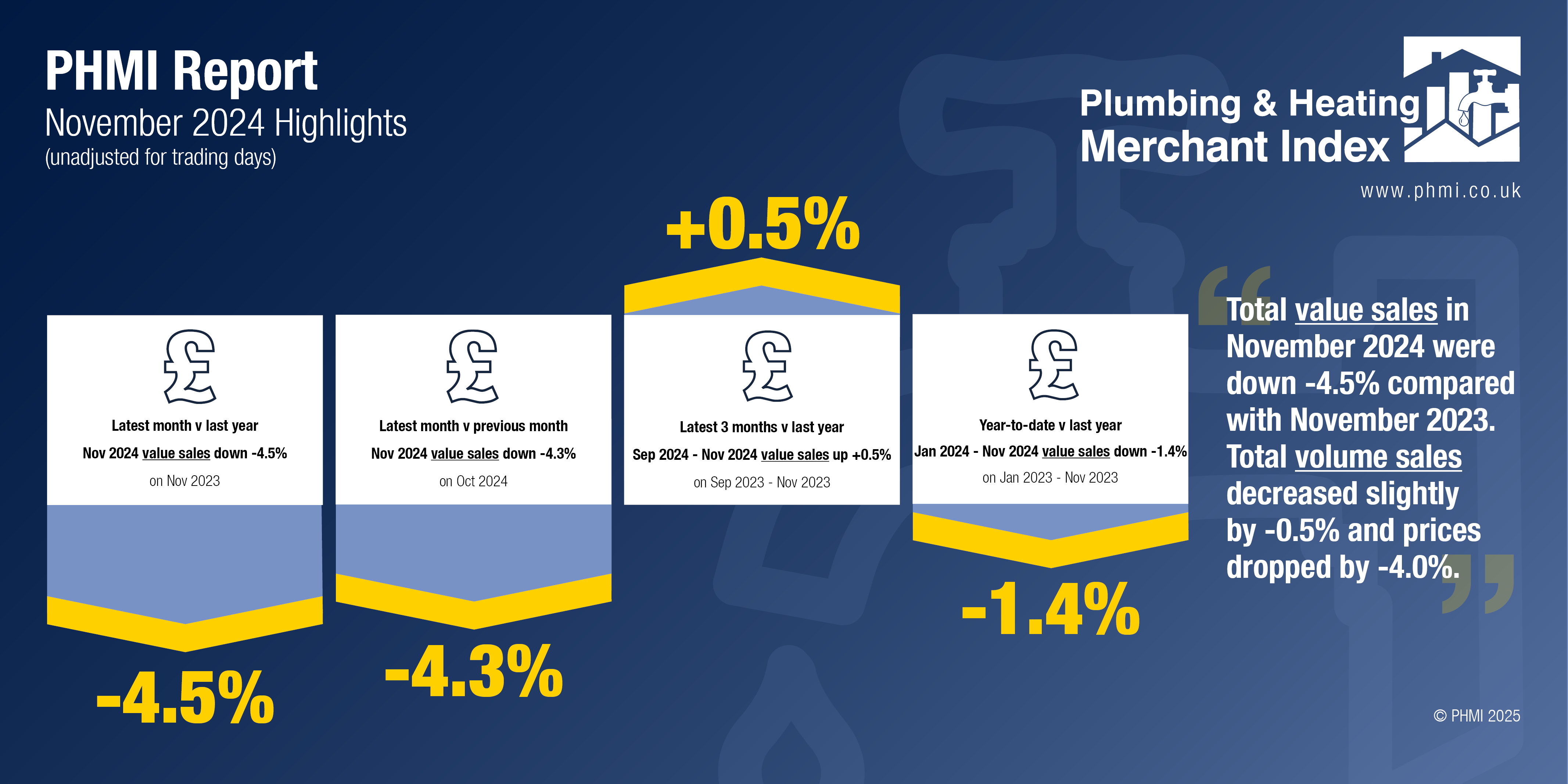

The latest figures from the Plumbing & Heating Merchant Index (PHMI) report show total value sales for November 2024 through specialist plumbing and heating merchants were down -4.5% compared to November 2023. Volume sales decreased -0.5% while prices dropped -4.0% year-on-year.

With one less trading day this year, like-for-like sales (taking trading day differences into account), were flat.

Month-on-month, November value sales were also down -4.3% compared to October. Volume sales fell -6.0% while prices rose +1.8%. With two less trading days in October, like-for-like sales were +4.9% higher.

Total value sales in the three months from September to November 2024 were +0.5% higher than the same period a year ago. Volume sales were up +4.4% but prices were -3.7% lower. There was no difference in trading days.

Value sales in the three months September to November 2024 were +18.9% higher than the previous three-month period (June to August 2024). Volume sales and prices both increased by 9.1%. With one more trading day in the most recent period, like-for-like value sales were +17.1% higher.

Plumbing & Heating merchants’ value sales in the 12-month period from December 2023 to November 2024 were down -1.6% on the previous 12-month period (December 2022 to November 2023). Volume sales were up +0.8% but prices dropped -2.4%. With two more trading days this year, like-for-like value sales were -2.4% lower.

November’s PHMI index was 114.5.

Mike Rigby, CEO of MRA Research, which produces the report, commented: “Falling volumes and prices made for a disappointing November for Merchants and their suppliers. And, in the short term at least, the deck seems stacked against growth.

“Having promised growth, the public and business weren’t expecting an abrupt change in tone and a budget that would postpone or prevent growth. Business and consumer confidence wilted rapidly as the Chancellor talked down the economy.

"But the new Chancellor was a new driver, and it took time for her to learn that people take what the Shadow Chancellor says with a pinch of salt, to the extent that they listen seriously. But they listen intently to the words and tone when the Chancellor speaks. And when the gloomy message is repeated many times over, sentiment shifts.

“UK consumer confidence fell sharply in January to the lowest level in more than a year as a rise in government borrowing costs and warnings of job cuts combined with gloomy Government rhetoric and howls of pain from businesses as they calculated the effects of the budget on their profit and growth prospects.

“NIQ GfK’s consumer confidence index — a measure of how people view their personal finances and broader economic prospects — fell 5 points to -22, the lowest reading since the end of 2023.

Neil Bellamy, Consumer Insights Director at NIQ GfK, added: “These figures underline that consumers are losing confidence in the UK’s economic prospects.”

“We could see a return to the ‘improve, don’t move’ mentality,” says Mike Rigby, “as homeowners prioritise budget-friendly projects to spruce up their properties rather than committing to large purchases or house moves.

"KPMG UK’s recent Consumer Pulse survey found that 21% of respondents were planning to spend money on minor home improvements, 14% were planning to spend on major home improvements, and 7% were planning to move house.”